Quick Facts About Car Prices

- In November 2023, average new car transactions were about 23% higher than the same month three years ago when no end was in sight for the pandemic.

- However, average transaction prices are flat compared with last year.

- Manufacturer incentives averaged about $2,500 in November. Incentives are up 136% from this time last year.

- You can easily find a new Jeep, Infiniti, Ram, or Volvo, though not necessarily a Toyota, Honda, Lexus, or Kia.

In the last several years, car shoppers have grown accustomed to paying more than the manufacturer’s suggested retail price (MSRP). They watched car prices steadily rise, with no end in sight. It left many shoppers scratching their heads, and the question our experts get most is, “When will new car prices drop?”

We can tell you that new vehicle price inflation has almost disappeared this year. That’s great news on its face. However, car prices have increased exponentially in the last three years. Now, the recent United Auto Workers strike threatens inventory and costs again.

In this story, we’ll explain how to navigate car buying so that if you’re in the market to purchase a vehicle, you’ll be equipped with the best information from our experts. We dig deeper to answer concerns about car prices dropping.

What Drives New Car Prices?

According to Kelley Blue Book data, new car average transaction prices (ATP) stayed flat month-over-month in November at $48,247. According to Cox Automotive analysts, new vehicle transaction prices fell more than 1.5% year-over-year as downward price pressure continues to favor buyers in the market.

“While consumers may feel some relief in vehicle prices and incentives as we close out 2023, automakers and dealers are feeling the results of the downward price pressure,” said Rebecca Rydzewski, research manager at Cox Automotive, the parent company of Kelley Blue Book. “The latest dealer sentiment survey by Cox Automotive clearly indicates that dealers are seeing profits contract as inventory levels return to normal, and incentives are turned up to help stimulate sales.”

Manufacturer incentives increased to an average of $2,500 in November, up 136% from a year ago. More on that in a bit.

Average transaction prices remain about 23% higher than in November 2020 as the realities of the COVID-19 pandemic seemed never-ending. At that time, average transaction prices for new vehicles were $39,259.

Vehicle Pricing Breakdown

- Non-luxury vehicle prices: In November, car buyers paid an average transaction price of $44,417. Overall, prices have held steady since January.

- Luxury vehicle prices: The average transaction price was $63,235 for luxury vehicles. Luxury vehicles make up about 20% of total vehicle sales. Luxury prices dropped by nearly 7.5% year-over-year.

- Electric vehicle prices: The average transaction for a new electric car is $52,345, down from about $65,000 a year ago. Tesla average transaction prices dropped nearly 21% compared to November 2022.

“In recent months, price parity between EVs and ICE has almost seemed possible,” said Stephanie Valdez-Streaty, director of strategic planning at Cox Automotive. “It is a complicated measure with plenty of variables, but newer products and higher discounts have brought down average EV prices, even before potential tax incentives. A year ago, the EV premium was more than 30%. Today, it’s less than 10%.”

These factors typically affect new car prices:

- Inventory availability

- Manufacturer incentives

- Dealer discounts

- Trade-in vehicle value

All four of those factors experienced major disruptions in the past several years.

New Car Inventory Update

Dealerships measure their stocks of new cars to sell in a measurement called “days of inventory” — how long it would take them to sell out of new vehicles at today’s sales pace if the automaker stopped building new ones. Last year, inventories fell to just one week. By the start of December, many brands’ inventories were up 57% from a year ago. That’s the highest inventory level since early spring 2021. However, a few carmakers, like Toyota, Honda, Lexus, and Kia, can’t fill all car orders due to a lack of inventory. Days’ supply calculations include vehicles in dealer inventory and in transit or pipeline.

Before the United Auto Workers strike in September, domestic car brands began adding excess vehicles to inventory. By contrast, inventory fell to record lows during the height of the pandemic and worldwide microchip shortage. Without enough crucial microchips, which control everything from engine timing to navigation systems, automakers couldn’t build cars as fast as they wanted. Despite near-normal car inventory for most carmakers, the lingering effects of supply chain issues and the chip shortage continue for some carmakers and particular models.

In 2022, manufacturers like Ford began rethinking inventories for the long haul despite the resolving chip shortage.

Which Automakers Have the Most Vehicles?

Cox Automotive’s analysis of its vAuto new and used car dealership management software data shows that brands like Lincoln, Chrysler, Jaguar, Alfa Romeo, Dodge, and Fiat offer days’ supply that’s well above twice the industry average. In contrast, inventory levels still sit well under normal for Toyota, Honda, Lexus, Kia, Land Rover, and Subaru.

RELATED: Is Now the Time to Buy, Sell, or Trade-In a Car?

Overall, the auto industry stocked 71 days’ worth of vehicles at the beginning of December. That’s considered a normal supply of inventory by historical standards, and it’s also the highest since early spring 2021. By comparison, automakers stocked a healthy 86-day supply of vehicles during the summer of 2019 before the pandemic.

Vehicle Incentives Hold Steady

Carmakers used more incentives to attract buyers than at any point in the past two years. In November, they remained unchanged. According to Kelley Blue Book’s analysts, carmakers spent 5.2% of the average transaction price on incentives meant to move vehicles. Incentives averaged about $2,500. Still, those are considered historically low compared to fall 2020, when incentives were about 20% of the average transaction price.

When automakers build up an oversupply of cars, they discount the vehicles to get them off dealer lots. For the past several years, carmakers and dealerships showed no glut of cars to sell, and they barely discounted. Now, supply is bulking up again, partly because of higher interest rates on car loans.

According to our analysis, the luxury car segment offered the biggest incentives through much of 2023. In November, luxury brand incentives reached 5.8% compared with non-luxury incentives at 5%.

Shop Around for the Best Offer on Your Trade-In

Trade-in value is another factor driving car prices. A lack of used vehicle stock is pushing prices higher, giving stock to the idea that buying a new vehicle is cheaper than purchasing a newer model used one. In that vein, it’s a great time to trade in your vehicle. Automakers scaled back production for several years after the 2008 recession. That leaves the higher-mileage, older cars dealers sell for less than $20,000 particularly hard to find now.

In other words, consumers trading in a 2018 Honda Civic will be much happier with the trade appraisal than those trading in a 2021 Jeep Grand Cherokee.

Shoppers should also be prepared to shop their trade-in around. It’s slightly more complicated to pull off, but selling your old car to one dealership may make sense, and buying your new car from a different one if the final invoice numbers work out better. Use the Kelley Blue Book Instant Cash Offer tool to shop your trade-in vehicle at nearby dealerships. When you let the deals come to you, you can select the best trade-in offer for your situation.

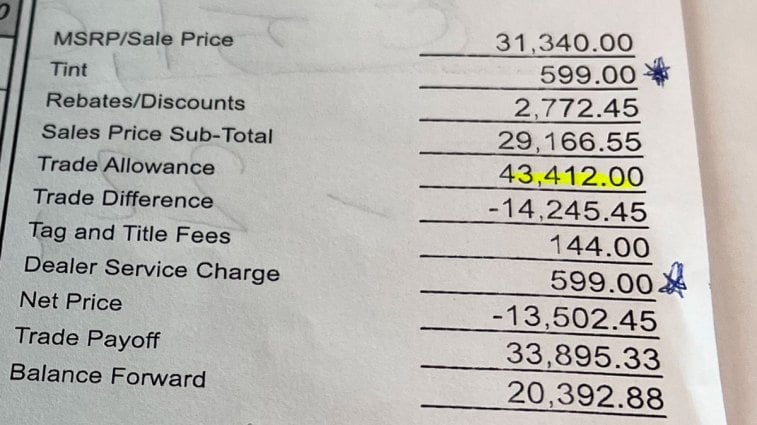

PRO TIP: I recently used the Instant Cash Offer tool to see what I could get for a family vehicle while sitting in a dealership trying to seal a deal for a subcompact SUV. The offers started flowing in as high as $50,000 for our 2021 Ford F-150 Lariat with a hybrid powertrain with low miles of 13,000 and no accident history. At the dealership where I was attempting to make the deal, they offered $43,412. With a Kelley Blue Book value of $50,196, I tried to use the other offers as leverage, but the dealership wouldn’t budge. So, I walked away from the dealership with the low-ball offer and went to another with the best offer.

New Car Prices Continue to Drop

So, when will new car prices go way down? For some brands and some dealerships, prices began dropping. With other brands, like Toyota, Honda, and Kia, shoppers must be prepared to hunt and pay more for tougher-to-find models. In recent months, hard-to-find cars and SUVs include the new Toyota Grand Highlander, Honda CR-V and its hybrid version, Toyota Camry, Toyota Corolla, Honda Civic, and Toyota RAV4.

Some Vehicles Still Sell at Markup Prices

While some carmakers and dealers with plenty of inventory provide incentives, others are still in short supply. It means some dealerships are still marking up select vehicles.

According to Markups.org, some Honda, Toyota, Ford, and Kia models sell above MSRP in places like California, Florida, and Texas. In Georgia, a Hyundai Tucson was marked up at a dealership in the Atlanta area.

PRO TIP: Since shopping recently for a vehicle, I found markups varied at dealerships that sold vehicles such as Kia and Hyundai. One dealer charged $599, and another $699. Another called them “doc fees.” Before you shop, understand how much those document filing fees cost for car tax, tag, and title in your state before you buy a vehicle. Those are pure markups or profit centers for the dealership. Another markup on an invoice may say “paint and fabric protection” or “window tint.” Before you sign anything, it’s wise to ask the salesperson to remove those fees if they really want to sell you the car.

What to Expect: Looking Ahead

But what if you desperately want a popular car that’s in low supply? Then, it’s time to test your patience. Federal Reserve interest rate hikes used earlier this year to rein in inflation still make it harder for consumers to buy cars. According to Cox Automotive research, the typical new car loan interest rate declined in December to an average of 9.6%. That’s down from about 10% in October. That means vehicle affordability is improving, even if slowly. Additionally, cooling inflation leaves the door open for interest rate cuts in the near future.

For now, car shoppers must remain flexible. Finding a low price on a new car is possible. It just may not be the car you thought you would buy. Or you may need to head to a smaller town outside the big city where there’s less competition.

Editor’s Note: This article has been updated for accuracy since it was originally published. Sean Tucker contributed to this report.